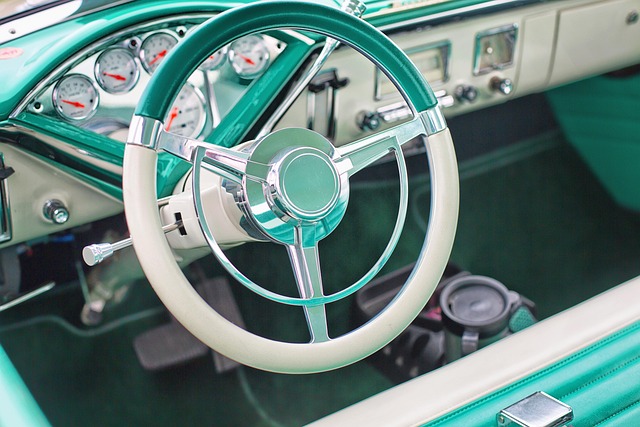

Schertz title loans offer a flexible financing option, securing funds against vehicle ownership for diverse needs like emergencies, business startups, or home improvements. With quick approval and manageable payments, these loans cater to individuals with limited credit history, fostering personal and professional development while providing access to investment opportunities and debt consolidation benefits.

Schertz title loans offer a unique opportunity for individuals seeking financial flexibility and growth. In this article, we explore smart ways to leverage these funds, unlocking creative potential and building wealth. From diversifying investments to managing unexpected expenses, we delve into strategic strategies that empower you to make the most of Schertz title loans. Discover how to navigate this powerful financial tool while maintaining long-term financial stability and growth.

- Unlocking Potential: Creative Schertz Title Loans Usage

- Financial Flexibility: Smart Strategies for Schertz Title Loans

- Building Wealth: Effective Investment Options with Schertz Title Loans

Unlocking Potential: Creative Schertz Title Loans Usage

Unlocking potential through Schertz title loans offers a unique opportunity for individuals to access funds quickly and creatively. These short-term loans secured against vehicle ownership provide a flexible solution for various financial needs. With quick approval processes, borrowers can turn to this alternative financing method when facing unexpected expenses or seeking capital for entrepreneurial ventures.

The versatility of Schertz title loans allows individuals to explore innovative usage scenarios. For instance, it can fund a small business startup, cover emergency medical bills, or even assist in home improvements. This creative approach leverages the value of one’s vehicle, ensuring access to much-needed funds with minimal hassle. It’s an attractive option for those seeking swift financial solutions without the constraints of traditional loan processes.

Financial Flexibility: Smart Strategies for Schertz Title Loans

Schertz Title Loans offer a unique opportunity for individuals seeking financial flexibility and quick access to capital. One of the smart strategies to utilize these loans is by considering them as a safety net for unexpected expenses. Whether it’s an emergency fund for medical bills or sudden repairs, Schertz Title Loans can provide fast cash when traditional banking options might not be readily available. This can be particularly beneficial for those with limited credit history or low credit scores who may face challenges in obtaining conventional loans.

By opting for flexible payment plans offered by Schertz Title Loans, borrowers can manage their funds more effectively. These plans allow individuals to pay back the loan at a pace that suits their financial comfort zone, ensuring they don’t strain their budget. This approach not only promotes financial stability but also enables folks to use these loans for various purposes, including education, small business investments, or even home improvements, thereby unlocking opportunities for personal and professional growth.

Building Wealth: Effective Investment Options with Schertz Title Loans

Schertz Title Loans offer a unique opportunity for individuals to tap into their asset and build wealth through strategic investments. With the funds acquired from these loans, borrowers can explore various investment avenues that align with their financial goals. One of the most effective ways to grow your money is by investing in stocks, bonds, or mutual funds. These options provide potential for significant returns over time, allowing you to diversify your portfolio and mitigate risks.

Additionally, Schertz Title Loans can facilitate debt consolidation, which is a powerful tool for financial management. By consolidating multiple high-interest debts into a single loan with potentially lower rates, borrowers can simplify their repayment process and save money on interest charges. This strategy not only improves cash flow but also enables individuals to focus on building wealth by investing the freed-up funds in productive assets, further enhancing their financial prospects. Flexible payment plans associated with Schertz Title Loans make it an attractive option for those seeking a tailored solution to their investment needs.

Schertz title loans offer a unique opportunity for financial flexibility and wealth building. By strategically utilizing these funds, individuals can unlock creative solutions, enhance their financial standing, and explore investment options that cater to their goals. Whether it’s for home improvement, business expansion, or savvy investments, smart management of Schertz title loans can lead to significant personal growth and a brighter financial future.