Schertz TX title loans offer fast, flexible cash financing using your vehicle's equity as collateral, with simple applications and quick approvals accessible for all credit histories. Lenders place a lien on your vehicle title until repayment through potential sale. Requirements include vehicle ownership, stable income, valid ID, good credit history, and direct bank deposit for consistent repayment processing. While ideal for emergencies or personal projects, these loans come with late fees, repossession risks, and interest charges; exploring alternatives like motorcycle title loans is recommended.

“Schertz, TX residents often turn to innovative financing options like title loans for quick cash needs. This comprehensive guide delves into the intricacies of Schertz title loans, offering a clear understanding of what they are and how they work. From eligibility criteria to benefits and considerations, this article equips borrowers with essential knowledge. Whether considering a Schertz title loan for emergency expenses or business opportunities, this overview ensures informed decisions, highlighting both advantages and potential drawbacks.”

- Understanding Schertz Title Loans: A Comprehensive Overview

- Eligibility Criteria for Schertz TX Title Loan Borrowers

- Benefits and Considerations for Schertz Title Loan Options

Understanding Schertz Title Loans: A Comprehensive Overview

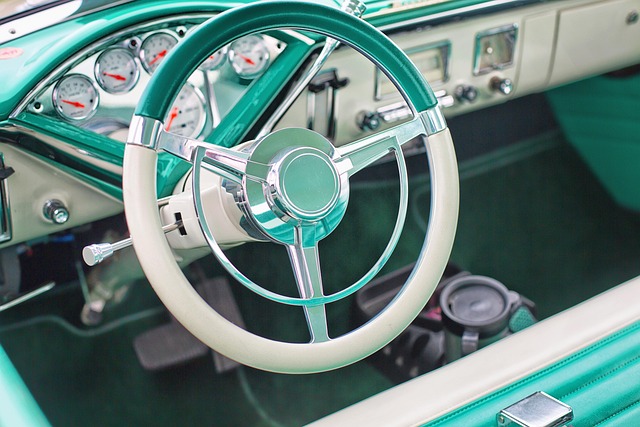

Schertz TX title loans offer a unique financing solution for individuals seeking fast access to cash using their vehicle’s equity as collateral. This alternative lending option is designed to benefit borrowers who need immediate funding, regardless of their credit history or score. In simple terms, Schertz title loans allow lenders to place a lien on the borrower’s vehicle title, ensuring repayment through the eventual sale of the vehicle if necessary.

These loans stand out due to their relatively straightforward application process and quick approval times. Borrowers can expect a hassle-free experience, where they provide proof of ownership for their vehicle and meet certain eligibility criteria. The simplicity extends to potential loan extensions, providing borrowers with added flexibility should unexpected financial situations arise during the repayment period. Car title loans, like those offered in Schertz, are thus a convenient and accessible means of securing funds when traditional lending routes may be less attainable.

Eligibility Criteria for Schertz TX Title Loan Borrowers

To be eligible for a Schertz TX Title Loan, borrowers must meet certain criteria. One key requirement is vehicle ownership; the car or truck serves as collateral for the loan. This ensures the lender has security in case of default. Additionally, applicants should have a stable income and valid identification to demonstrate their ability to repay the title loan.

Another essential factor is the borrower’s credit history. While not always a strict necessity, having good credit can increase the chances of approval and potentially lead to better interest rates. Lenders also mandate direct deposit into the borrower’s bank account for consistent repayment processing. By keeping your vehicle and maintaining timely payments via direct deposit, you can maintain ownership and avoid repossession.

Benefits and Considerations for Schertz Title Loan Options

Schertz TX title loans offer a unique financial solution for borrowers who own valuable assets like vehicles or motorcycles. One of the key benefits is the ability to access substantial funding by using the equity in your vehicle as collateral. This can be advantageous for those seeking quick cash to cover emergency expenses, consolidate debts, or fund personal projects. The process typically involves a simple application, vehicle inspection, and evaluation of your title’s value, allowing borrowers to obtain funds relatively faster than traditional loan options.

However, it’s essential to consider the implications of taking out a Schertz title loan. While it provides access to immediate capital, failing to repay on time can result in late fees and even the risk of repossession. Additionally, borrowers must be prepared for the loan payoff process, which may require them to pay off the entire amount plus interest within a specified period. As with any loan, a thorough understanding of the terms, including interest rates and potential penalties, is crucial before securing a Schertz title loan. Considering alternative options like motorcycle title loans or exploring ways to negotiate better terms can also be part of a strategic financial decision-making process.

Schertz title loans offer a unique financing solution for those in need of quick cash. By understanding the eligibility criteria, benefits, and considerations outlined in this article, borrowers can make informed decisions. Remember that while Schertz title loans can provide relief during financial emergencies, it’s crucial to borrow responsibly and have a clear repayment plan to avoid potential pitfalls.